Form 2290 Download

IRS Form 2290 plays a crucial role in ensuring that heavy highway vehicles are taxed fairly and efficiently. If you're a brave soul embarking on this tax-filing quest, fear not! We'll guide you through the enchanted forest of Form 2290 instructions, so you can conquer the task with ease.

IRS Form 2290 Purpose for U.S. Taxpayers

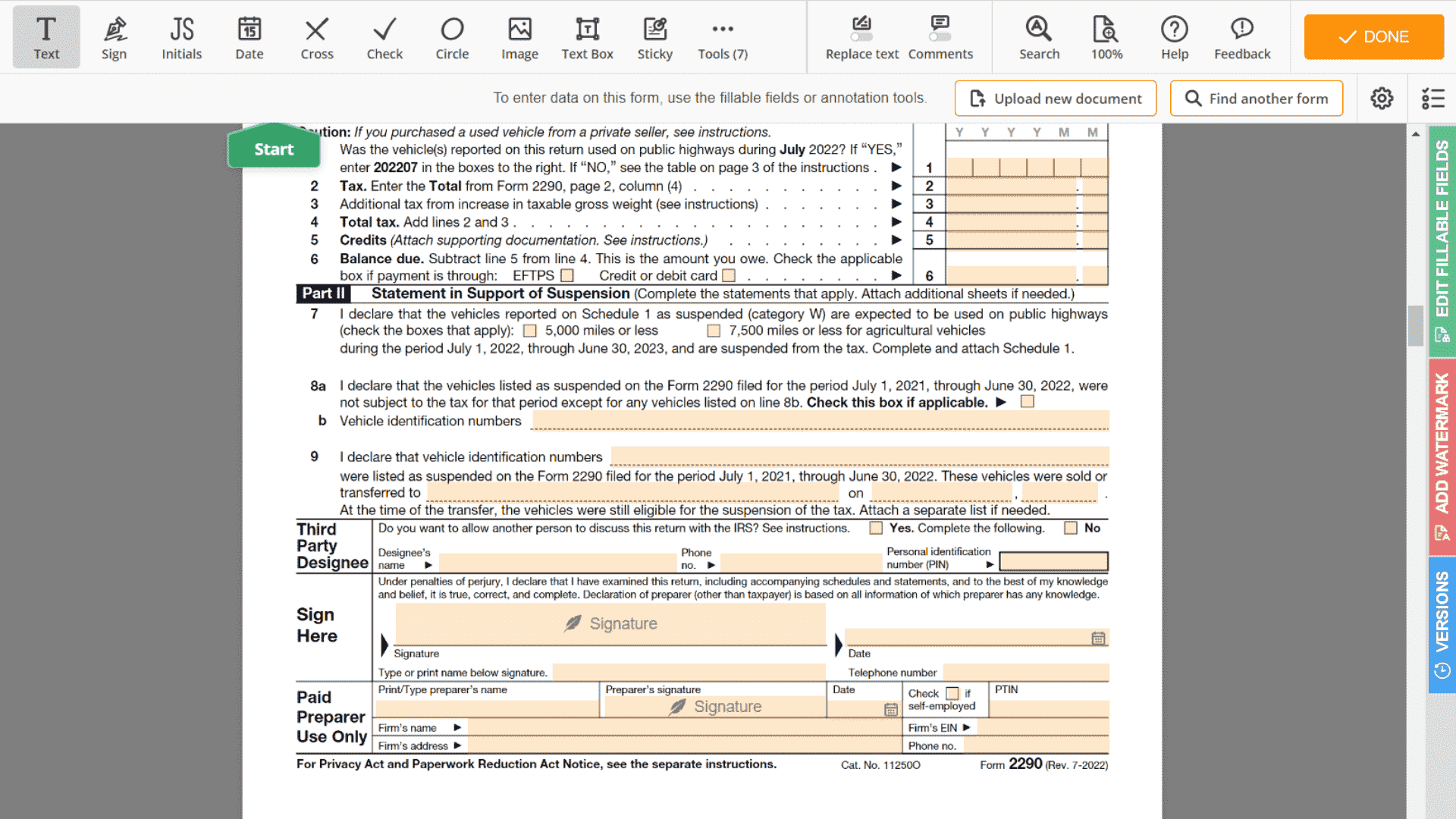

The importance of the IRS Form 2290 cannot be overstated – it's a vital document for truckers and vehicle operators alike. This document calculates the Heavy Vehicle Use Tax (HVUT) owed on vehicles weighing 55,000 pounds or more. The collected HVUT funds are then used to maintain and improve the nation's highways, making your journey smoother and safer. So, by filing your Form 2290 online, you're not only fulfilling your legal obligation but also contributing to the greater good of the land.

Steps to Fill Out the 2290 Tax Form

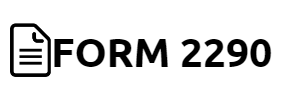

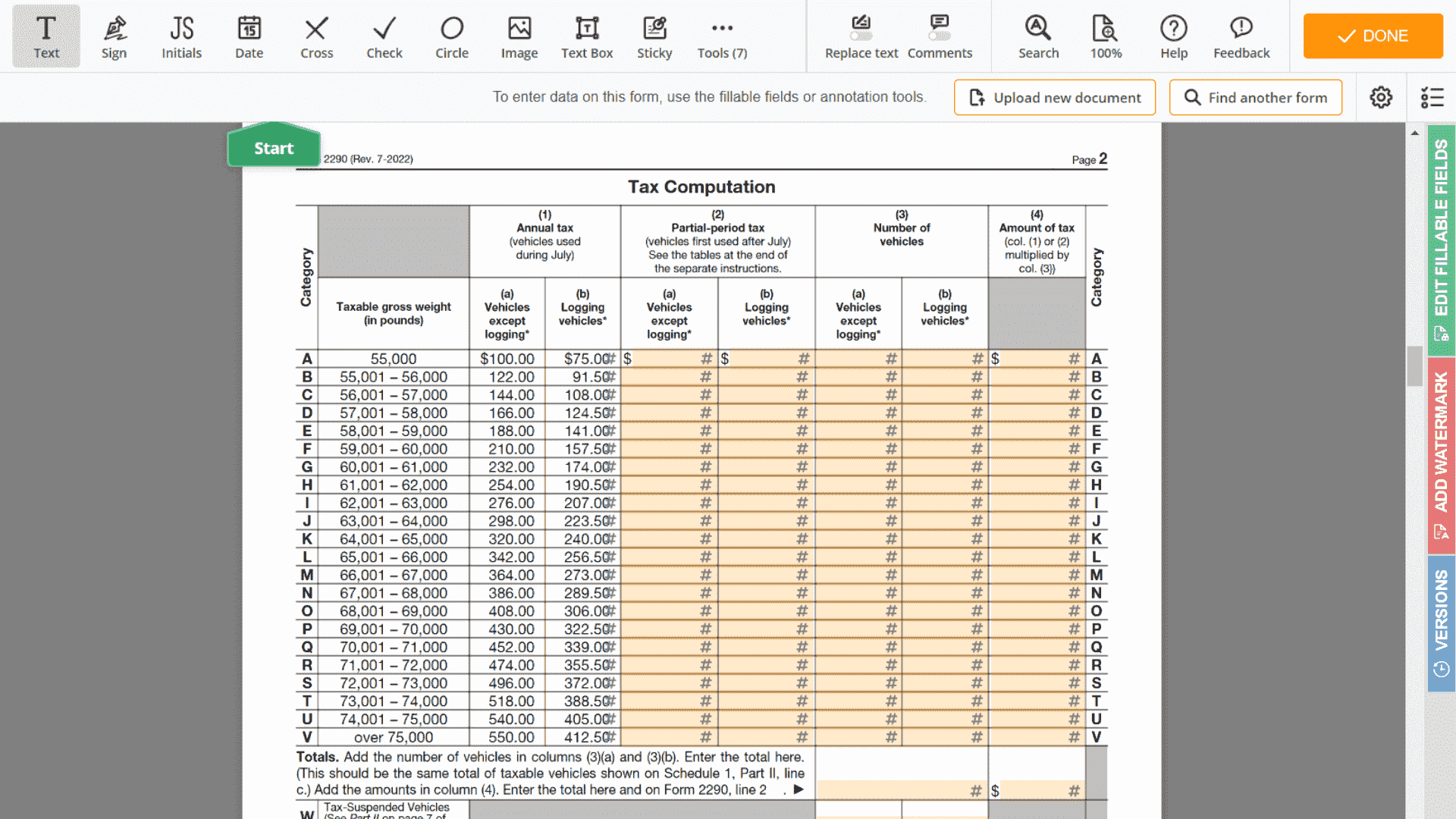

Now that you understand the significance of this essential document, let's explore how to obtain the 2290 form for download and complete it. Begin by visiting our website, where you can find the IRS 2290 form printable version. Next, follow these steps to fill out the blank template:

- Provide your Employer Identification Number (EIN) and Vehicle Identification Number (VIN).

- Calculate your HVUT based on your vehicle's weight and mileage.

- Indicate any exemptions or credits you may be eligible for.

- Submit your payment, either through the Electronic Federal Tax Payment System (EFTPS) or by check or money order.

Details to Pay Attention for

As you complete your printable Form 2290 for 2022, beware of the common mistakes that can lead you astray. Keep these pitfalls in mind:

- Entering incorrect EIN or VIN

- Miscalculating the tax amount

- Failing to sign and date the template

- Neglecting to submit payment

If you commit any of these errors, the IRS may reject your sample, and you could face penalties for failing the copy or providing fake data. This can include fees, fines, or even the suspension of your vehicle registration. So, it's crucial to double-check your information and ensure you've followed the Form 2290 instructions accurately.