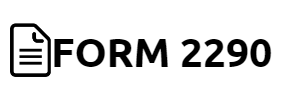

IRS Form 2290 for 2022-2023

IRS Form 2290: Heavy Vehicle Tax Filing Made Simple

IRS Form 2290, also known as the Heavy Highway Vehicle Use Tax Return, is an essential tax document that truck owners and operators in the United States must file. This statement is required for trucks weighing 55,000 pounds or more and is utilized to calculate and pay the federal highway use tax. IRS Form 2290 in 2023 must be accurately completed and submitted to ensure compliance with tax regulations and avoid potential penalties.

To assist taxpayers in understanding and completing the example, our website 2290-form.net offers valuable resources, including detailed 2023 Form 2290 instructions. By utilizing these materials, taxpayers can confidently navigate the filing process and ensure they comply with all applicable tax laws. Additionally, the website provides a free printable 2290 form for easy download and printing. The examples provided on the website further clarify the form's requirements, making it an invaluable tool for those seeking a comprehensive and user-friendly guide to completing and submitting the 2022 Form 2290 PDF.

2290 Tax Form Assignments

Individuals who must file the 2290 form operate a vehicle with a taxable gross weight of 55,000 pounds or more on public highways in the United States. The taxpayer can obtain the 2290 form to print out for submission to the IRS or file it online.

If you operate a heavy highway vehicle as part of a business and you make payments to contractors, service providers, or employees, you might be required to issue Form 1099-MISC to report those payments, depending on the nature of the payments and the amount involved. You can obtain the blank template for the 2023 tax year at the 2290-tax-form.zendesk.com website, along with the detailed instructions.

Form 2290: Example of Use in 2023

For example, meet John Grant, a successful trucking business owner. He recently purchased a new semi-truck that has a taxable gross weight of 60,000 pounds. As a responsible business owner, John knows that he must file the sample of the 2290 form for his new truck before the deadline to avoid any penalties. To make the process more convenient, John decides to file the 2290 form online. To ensure he has the most up-to-date template,

John downloads the 2290 form for 2023 from our website. After carefully reviewing the instructions and guidelines, he completes the PDF accurately, providing all the necessary information. To help others in similar situations, John shares a 2290 form example on his company's social media page, demonstrating the correct way to fill out the copy and explaining the importance of timely submission.

IRS Form 2290: Filling Instructions for 2022-2023

Filling out the IRS Form 2290 for 2023 can be a daunting task, especially for those unfamiliar with its intricacies. To simplify this process, we've outlined four simple steps to follow when completing heavy vehicle use tax 2290. Following these steps can help you avoid any mistakes and ensure that your copy is executed correctly.

IRS Form 2290 Deadlines: Stay Compliant & Avoid Fines

The due date to file the printable 2290 tax form is August 31st for the current fiscal year. It is essential to ensure timely submission to avoid penalties. Failure to file IRS Form 2290 on time may result in a penalty of 4.5% of the total tax due, assessed on a monthly basis for up to five months. Additionally, providing false or fraudulent information may lead to a penalty of 0.5% of the total tax due, along with potential criminal charges. Maintaining accuracy and timeliness when filing your taxes is crucial to avoid these consequences.

Check out more of our websites:

Federal Form 2290: Ways to File for 2022-2023

There are two primary methods to submit the 2290 form to the IRS: the printable version and the online filing. Choosing to print the 2290 form for 2023 is a convenient option for those who prefer a more traditional, paper-based approach. This method allows taxpayers to physically fill out the form, providing a sense of control over the accuracy of their information. Additionally, having a hard copy of the completed form can serve as a useful reference for future tax-related matters.

Form 2290 Fillable PDF

On the other hand, choosing to fill out the 2290 form online offers several benefits, such as increased efficiency and faster processing times. Online filing systems are designed to streamline the submission process, reducing the likelihood of errors and ensuring all required information is provided. Furthermore, electronic filing is both environmentally friendly and cost-effective, as it eliminates the need for paper and postage.

Top FAQs for the 2290 Tax Form: Answers & Solutions

Federal Tax Form 2290 Instructions for 2022-2023

Please Note

This website (2290-form.net) is not an official representative, creator or developer of this application, game, or product. All the copyrighted materials belong to their respective owners. All the content on this website is used for educational and informative purposes only.